Greenlight is a popular reloadable debit card service for kids, where parents can manage and track their kids spending. You can also add an allowance, payments for recurring chores or one-time jobs, and teach them compound interest via “parent-paid interest”. I suppose its wise to show the kids how handle digital spending before the credit card offers arrive.

I decided to try out the new PSECU perk that offers the basic tier of Greenlight for free. (I did the PSECU $300 checking promo first.) You must enroll at Greenlight.com/PSECU and link a PSECU checking account in order to get the benefit. The “Greenlight Select” membership is a special tier for such partners, but is mostly comparable to the “Greenlight Core” tier on their website, which costs $4.99 a month. Included in the “Greenlight Select” membership:

- Debit Mastercards for up to 5 kids. Send money instantly and keep tabs on spending with real-time notifications.

- Educational app. The parents have their app where they get notified of every purchase, and the kids have their own app with educational games and short lessons (optional). Kids can divide their money into “savings” or “giving” baskets as well as create specific savings goals.

- Parental controls. Created automated allowance payments. Set category and store-level spending limits.

- 1% APY interest. This is the lowest tier and the lowest interest, although some other apps don’t pay any interest at all. You can get up to 5% APY on $5,000 if you upgrade to the $15/month tier.

- Roundup feature. You can set it to round up purchases to the next dollar and put the difference in a savings account.

- No overdraft fees. Does not allow overdrafts, so no overdraft fees.

- Banking services provided by Community Federal Savings Bank, member FDIC.

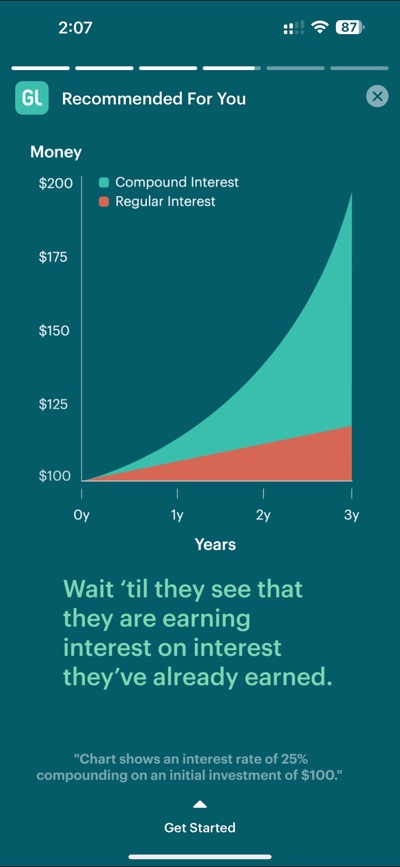

Teaching compound interest with higher interest rates. It can be hard to visualize compound interest at low interest rates, so parents can increase it by paying a higher “interest” rate out of their own pockets. For example, here is an illustration of $100 earning a 25% interest rate (paid by the parent) as opposed to a 5% interest rate. It makes the idea of earning interest on interest more immediate and tangible. Ideally, this can teach them that delayed gratification turns it into future rewards. You can set interest rates from 1% up to 100%.

Unfortunately, to add on investments, I would have to upgrade to the $10 a month tier or higher. If I had a teen ready for investing, I’d probably use the Fidelity Youth account instead (available for age 13-17 only, and my kids aren’t that old yet).

For kids under 13, I think that Greenlight would serve as a nice alternative to piggy banks. (Greenlight has no minimum age requirement.) While I suppose $5 a month isn’t a lot of money for all these features, I still like “free” better. After a few quick internet searches for “Greenlight Select”, I found multiple local banks and credit unions in my area that offered this free tier of service. If you plan on paying for it, there is $30 bonus available with a 1-month free trial (bonus not stackable with this free offer).