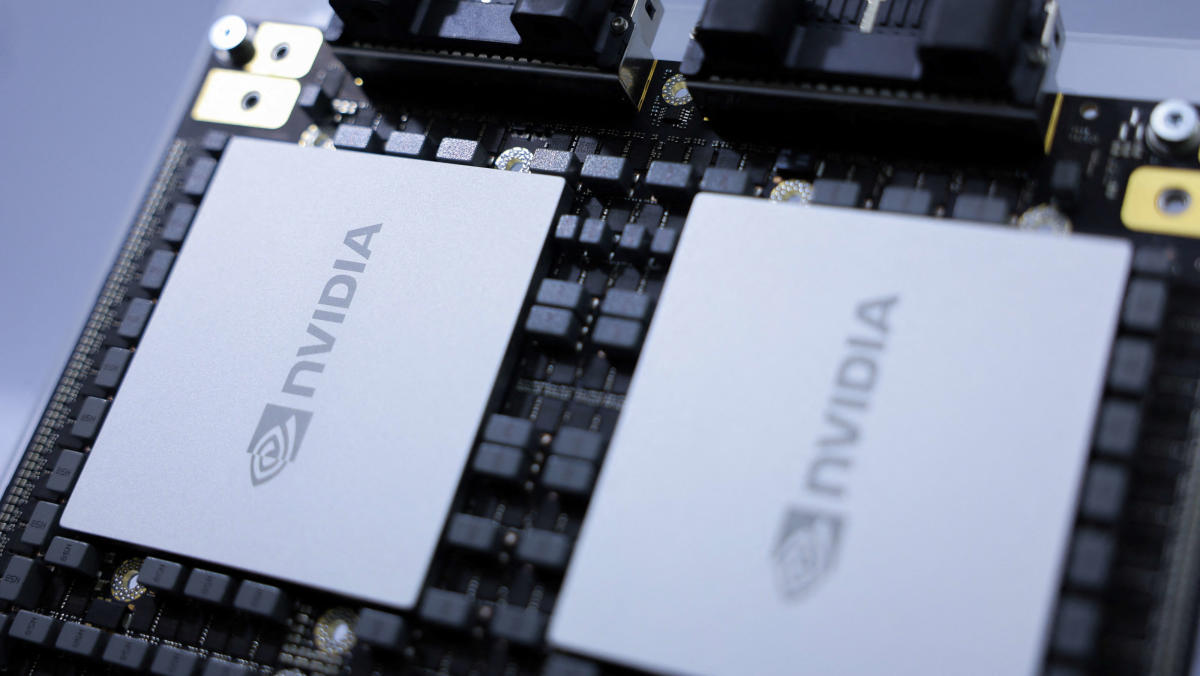

As the AI race heats up, Ram Ahluwalia, Lumida Wealth Management CEO, joins Catalysts to discuss how the competition may weigh on Nvidia (NVDA).

“I think we’re still in the early innings for Nvidia. Nvidia clearly is capturing the bulk of the value capture in the sector and industry,” Ahluwalia tells Yahoo Finance. He expects Nvidia stock to hit $150 by the end of 2024, especially as hyperscalers intend to spend between $50-$100 billion on GPU compute.

Ahluwalia believes “there’s no question” about Nvidia being the first company to reach a $4 trillion valuation. He argues, “We made a call earlier this year that Nvidia would be the most valuable company in the world. It achieved that milestone yesterday, and the demand for GPU chips is strong. And you’re seeing enterprises start to get some ROI (return on investment) on it from the early adopters — Meta’s (META) seen ROI on their CapEx (capital expenditures) spend. So, we think Nvidia’s got plenty of room to grow from here.”

Of the “Magnificent Seven” players, he sees Nvidia as the AI winner alongside Alphabet’s Google (GOOG, GOOGL) and Meta.

To watch more expert insights and analysis on the latest market action, check out more Catalysts here.

This post was written by Melanie Riehl