A new report from Bloomberg New Energy Finance (BloombergNEF) warns that the big boom in EV battery factories worldwide may actually result in far more manufacturing capacity than there will be demand for batteries by the end of this decade. That’s a far cry from the usual rightwing spin that we can never transition away from fossil fuels because there simply aren’t enough raw materials to build all the batteries we’d need. As far as we can tell, BloombergNEF didn’t clear its research with the Heartland Institute.

The Bloomberg story (also available paywall-free at Yahoo, albeit without any links in the text) reports that even though there’s rapidly growing demand for lithium-ion batteries “as automakers electrify their fleets and utilities install big batteries to stabilize the power grid,” there have been so many battery factories announced that

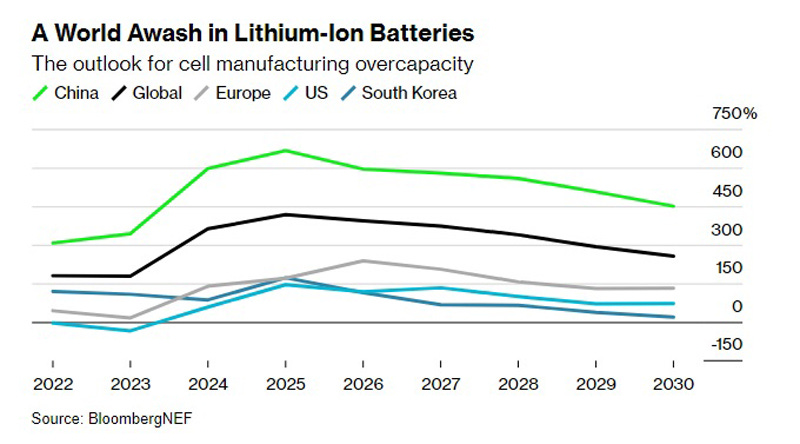

By the end of 2025, the global battery industry will be able to produce more than five times as many cells as the world will need that year, BNEF forecasts in its latest Electric Vehicle Outlook. [subscriber-only link — Dok]

“This is good news for automakers and EV buyers but marks a challenging time ahead for new entrants to the battery industry,” the report said.

The article notes that China is on track to have 400 percent more manufacturing capacity than demand, and points out that the rest of the industrialized world is launching battery factories like crazy, too. That of course includes the US, where the Inflation Reduction Act’s tax incentives have launched a boom in new EV battery factories too.

The story even includes a graph with the not at all hyperbolic heading, “A World Awash in Lithium-Ion Batteries,” showing the projected excess battery manufacturing capacity around the world, peaking in 2025 and then going down by the end of the decade, but still far outpacing projected demand.

The overcapacity in battery manufacturing, the report says, will probably result in a shakeout in the industry as factories get cancelled because they won’t be needed, an issue that BNEF energy storage research head Yayoi Sekine said “will be a problem everywhere, including in the US.”

However, the Bloomberg article then cites as an example last July’s decision by Ford to “ratchet back” its plans to expand EV production, “citing a price war for battery-powered cars and trucks.” The problem there is that Ford was responding not to a glut of battery manufacturing, but to the temporary slowing of demand for new EVs, a problem that already seems to be diminishing as Ford and other manufacturers see higher demand for the rest of 2024.

Beyond that, we have other questions, too. The big one is pretty simple: What about batteries for grid storage, an area where demand is, at least for now, growing nigh-exponentially? Apart from a brief mention of electric utilities installing “big batteries to stabilize the power grid,” the Bloomberg story otherwise appears to focus on EVs, which makes sense, given that’s the focus of the BNEF report.

We also downloaded the Electric Vehicle Outlook’s executive summary, which is available to the public without a subscription, and it’s pretty bullish on the outlook for EVs. (Yay!) But the summary doesn’t go into the question of grid-scale storage in much detail either, apart from a mention that it’s included in one of the report’s projected scenarios (in which there would still be an oversupply of capacity).

Now, we won’t pretend to be experts on economic forecasting, but before we get too worried about drowning in batteries, we want to see what other clean energy boffins have to say about the demand for grid scale electricity storage, a market that at the moment is growing far more quickly than expected. If the world is going to get off fossil fuels altogether, I don’t know that too many batteries is going to be the problem, although of course the giant batteries used on the grid are built differently than the smaller battery packs in EVs.

On that, another encouraging reminder from the Bloomberg story, which is that the stuff that goes into batteries is also changing as the industry grows, shifting from mostly lithium-ion batteries today, to greater use of lithium iron phosphate batteries, which are quickly becoming the norm in Chinese EVs.

That’s a positive development for the energy transition overall (yay!):

Their component materials are cheaper than the standard lithium-ion cells that use nickel, manganese and cobalt, and the shift could substantially lower future demand for those metals. BNEF cut its forecast for the amount of nickel used in batteries next year by 25%.

But don’t worry. The fossilheads will no doubt find a way to put a negative spin on that too. For instance, won’t it put a lot of child laborers in unsafe mines out of jobs?

PREVIOUSLY!

[Bloomberg (also at Yahoo Finance) / Photo: Heather Kennedy, Creative Commons License 2.0]

Yr Wonkette is funded entirely by reader donations. If you can, please become a paid subscriber, but if a one-time donation is more your style, that’ll charge our batteries too!