Benjamin Franklin once quipped that the only two certainties in life are death and taxes. (The more solipsistic mega-rich, it might be noted, often try to cheat both.) In other, less clever words, taxes are inevitable. That’s how I’ve always thought about taxes: they are just something that, as a dutiful citizen of the State of New York and the United States of America, I have to do every spring. I’d spend an afternoon poring over 1099s, W-2s, and credit card statements, and send the results to my accountant. If I was lucky—and I usually was—I’d get a nice check back from the IRS.

In my mind, this annual bookkeeping process was something that just happened once a year, immutably, like the vernal equinox. Then I read Michael Graetz’s important new book, The Power to Destroy: How the Antitax Movement Hijacked America, and I realized that taxes are only like the vernal equinox if a coalition of selfish antitax weirdos lurked in the heavens, rearranging the planets to hog the sunlight and keep the rest of us in the dark.

“This antitax movement,” Graetz, a Columbia Law School alumni professor emeritus of tax law and my guest on today’s PREVAIL podcast, tells me, “is the most important overlooked social and political movement of the last half century. And it has been successful, without setbacks, to the day now, as we’re talking, in a way that the civil rights movement has not been successful.” The civil rights movement, he says, has “experienced lots of setbacks in voting in schools and others. The women’s movement has experienced massive setbacks in the abortion context. And the LGBTQ movement is facing huge issues. . . . And yet the antitax movement, despite all of these shortcomings that you and I have discussed, continues and continues vigorously.”

Just as Leonard Leo and his reactionary ilk engineered a relentless, decades-long, and ultimately successful plan to capture the Court and jerk it so far to the right that it may yet fall over, a similarly radical confederation of antitax zealots have done the same with federal tax policy—and with arguably even greater success. The Power to Destroy is the Evil Geniuses of this antitax effort: a well-written, meticulously researched, easy-to-read account by an expert in the field.

Taxes are political. Taxes impose a value system on a society. That sounds like a simple idea, but I had never considered it quite that way before. As Graetz writes in the book,

The tax law is laden with fundamental cultural, social, economic, and political judgments. For example, the income tax favors homeowners over renters, promotes charitable gifts over family transfers, and provides substantial benefits for savings for higher education or retirement. The tax also advantages certain forms of business organizations over others, and frequently rewards specified investments, such as for real estate. Individual income tax rates are lower for dividends and capital gains than for wages. Alcohol excise taxes favor wine drinkers over beer drinkers, and both over people who sip whiskey. These political choices please some people and foment antitax attitudes in others.

Historically, the antitax movement was steeped in racism and nativism. Cranky well-to-do white people resented having to pay more in taxes to underwrite welfare programs that tended to help people of color, or fund public schools attended in the main by children of immigrants. Ronald Reagan, who took an axe to income taxes in his first term, constantly played on these racist tropes. I was not yet eight years old during the 1980 campaign, and even I remember him blathering about a mythological welfare queen—a woman we knew to be Black even though he never said so, and who had gamed the system, and who presided over a fleet of Cadillacs.

Reagan was a charismatic figure. People liked him. But he also got votes because he leaned into what Graetz calls “the linchpin that held the various pieces of the Republican coalition together”—antitax policy. “It was something that everybody agreed on: the social conservatives, the Christian evangelicals, the business community, and so forth.”

Social conservatives tended to be racist. Christian evangelicals didn’t want their religious schools—still segregated in much of the South, a middle finger to Brown v. Board of Ed.—to fall prey to the taxman. Businessmen were greedy. Reagan harnessed all of that antitax rage and rode it to two terms in the White House, where he began to “starve the beast.”

While Reagan constantly lambasted Democrats for their reckless spending, urging fiscal restraint, he blew through money like the drunkest of all drunken sailors. He had to, to pay for the tax cuts. “Ronald Reagan, when he came into office, the federal debt was less than a trillion dollars,” Graetz tells me. “And when he left office, it was three times as much. It was $2 .7 trillion. He accumulated more debt during his presidency than had been accumulated in the entire history of the nation up until 1981, all the while talking about balancing the budget and arguing for a constitutional amendment to balance the budget as if that made any sense for the federal government.”

Poppy Bush did not win a second term, largely because, being responsible, he had broken his “read my lips” pledge to not raise taxes. Then Bill Clinton came along, and created a surplus. George W. Bush—in more ways than one a profligate son—burned through the Clinton surplus and racked up enormous debt on account of the War on Terror and the simultaneous tax cuts for the rich. Obama cleaned up Dubya’s fiscal mess as best he could. Then Trump came along and just obliterated cash like his father would swoop down from the heavens with $10 trillion in casino chips to bail him out. Biden has tried to make sweeping changes to the tax codes, to bring the balance back, but his efforts have been stymied by a hapless Congress.

Right now, Graetz says, “we have the highest level of federal debt as a share of the economy that we’ve had since the end of the Second World War. But at the end of the Second World War, the United States had all the money there was. Europe was a shambles. Japan was a shambles. China was entering into a dark Communist period. Russia was trying to rebuild from the war and was interested only in defense, not in helping its people. And we entered into a period of prosperity and widely distributed economic growth that’s sort of unprecedented. But at that time, the debt was 106 percent of the economy, of GDP. Ninety-five percent of that debt, post-war debt, was owed to Americans. So Americans had bought all of the debt during the war, essentially.”

This is no longer the case. “Today, the debt is now at a hundred percent of GDP. It’s the highest it’s been since [after the war], and it’s going up dramatically over the next number of years. Interest rates, according to a forecast of the Congressional Budget Office this week, are going to be 3.3 percent of GDP this year and next year. . . . That’s greater than the rate of economic growth. So what that tells you is that every dollar that the U.S. accumulates through economic growth over the next several years will be going to pay interest on the federal debt.”

But wait! It gets worse!

“Roughly 30 to 35 cents of every dollar of those interest costs is going abroad,” Graetz continues. “Much of it to countries that we don’t consider close friends—including China, which holds a lot of debt. . . . So we’re now in a position, as I said, where interest has become the fastest growing expenditure of the federal government.”

At the end of the day, this is a math problem. Sooner or later, the piper must be paid. The Republicans are obstructionists who routinely play chicken with the debt ceiling, which, if allowed to lapse, would be catastrophic for the economy. Congressional Democrats, as Graetz points out in our discussion, have historically been willing co-conspirators on a lot of these tax cuts. And these days, everything grinds to a halt at the whim of the venal senators Joe Manchin and Kyrsten Sinema. If Trump is re-elected, there will certainly be more tax cuts—cuts that may mortally wound our economy. And with regards to the debt ceiling, I’m not confident that FPOTUS fully grasps the grave danger in, essentially, repudiating our national debt. Louis XVI tried that in France, because he didn’t want to tax the rich or the clergy. That decision cost him both his crown and his head.

“I think that we’re in a more precarious financial situation than we’ve ever been in,” Graetz says. “And we’ve got a global economy with real competitors We no longer have all the money there was. And I think it’s unsustainable.”

Herbert Stein, who was Richard Nixon’s chief economist, said something to Congress in the Reagan years, in a hearing about the deficit. “He told Congress what became Stein’s Law,” Graetz tells me, “which is: If something cannot go on, it will stop. And the question is, how will this stop?

“I do not know how it’s going to stop.”

S7 E2: Trickling Down: How the Anti-Tax Movement Hijacked America (with Michael Graetz)

In this conversation with Greg Olear, Michael Graetz discusses his book “The Power to Destroy: How the Anti-Tax Movement Hijacked America”’ He explores the history and influence of the anti-tax movement, the role of race and xenophobia in shaping it, and the ideological and moral arguments behind it. Graetz also delves into the consequences of irresponsible tax cuts, the significance of taxation in American history, and the challenges of dealing with a GOP that obstructs. He highlights the need for a more nuanced understanding of taxation and the importance of addressing the growing national debt. Finally, they discuss the conservative shift of the Court, the corrupting power of money in politics, and the challenges facing American democracy. Plus: a new memory aid.

- 00:00: Introduction

- 12:00: Beginning of interview.

- 17:25: Cultural, Social, and Political Judgments Embedded in Tax Law

- 22:09: The Influence of Libertarianism and Ayn Rand

- 38:43: The Consequences of Irresponsible Tax Cuts

- 58:28: The Failure of Supply-Side Economics and the Divisions in American Politics

- 01:13:03: SCOTUS / Money as Speech in Politics

About Michael Graetz:

https://www.law.columbia.edu/faculty/michael-graetz

Buy the book:

https://press.princeton.edu/books/hardcover/9780691225548/the-power-to-destroy

https://www.amazon.com/Power-Destroy-Antitax-Movement-Hijacked/dp/0691225540

Prevail is sponsored by BetterHelp. Get 10% off your first month at betterhelp.com/greg

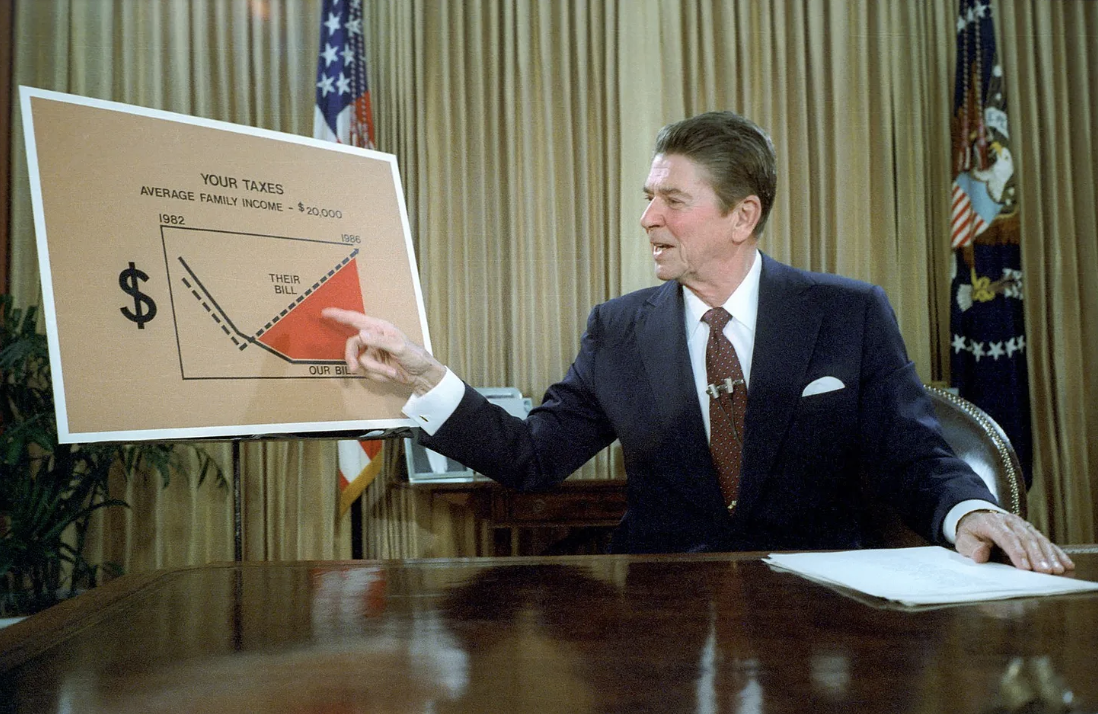

Photo credit: White House Archives. Reagan gives a televised address from the Oval Office, outlining his plan for tax reductions in July 1981.